The Goods and Services Tax Council, under the chairmanship of Union Finance Minister Nirmala Sitharaman, Saturday decided to reduce the GST rates on certain items being used in Covid-19 relief and management till September 30, 2021.

Here are the key decisions that were taken during the 44th GST Council meeting:

— The GST Council has agreed to stick to 5 per cent tax rate on vaccines.

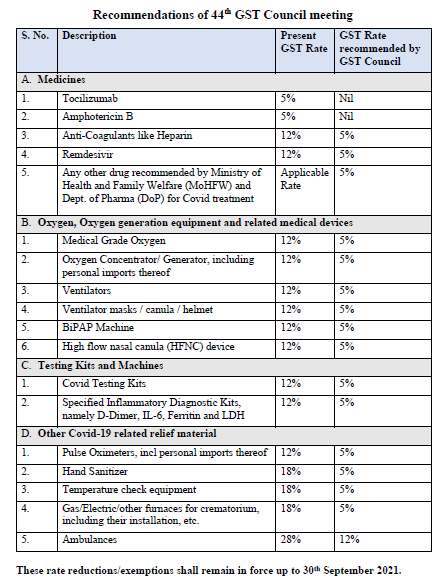

— The Council has slashed the tax rate on Covid-19 medicines such as Remdesivir and equipment like oxygen concentrators and medical grade oxygen.

—GST rates on Tocilizumab and Amphotericin B have been slashed to nil from 5 per cent. The rate on Remdesivir and anti-coagulants like Heparin has been lowered from 12 per cent to 5 per cent.

—Tax on medical grade oxygen, oxygen concentrators, ventilators, BiPAP machines and high flow nasal cannula (HFNC) devices has been cut to 5 per cent from 12 per cent.

—Tax on Covid testing kits has been brought down to 5 per cent from 12 per cent.

—Pulse oximeters, hand sanitisers, temperature check equipment and ambulances too will attract lower 5 per cent tax.

The meeting was also attended by Union Minister of State for Finance Anurag Thakur besides Finance Ministers of States & UTs and senior officers of the Ministry of Finance & States/ UTs.

Earlier this week, a group of ministers led by Meghalaya chief minister Conrad Sangma had recommended no change in the 5 per cent GST rate for Covid-19 vaccines, while suggesting reduction of the GST rate temporarily to 5 per cent for both commercial imports and domestic supply of most other Covid medicines and materials.